Somewhere in the middle of Season 5 of the Office, Oscar pops into Michael’s office to explain a budget surplus. Michael asks Oscar to explain it to him, “like I am an eight-year-old.” When the response is delivered with the terms ‘fiscal year’ and ‘x-axis,’ Michael changes his mind and says, “why don’t you explain this to me like I’m five.”

We hear you, Michael. This stuff is complex. Here at POW, it is our job to dive into the nitty-gritty details of policy and identify the best opportunities for our community to have an impact.

When it comes to the next stimulus package, that’s exactly what we’ve been doing: sifting through the wonk and teaming up with our allies to determine a reasonable, feasible clean energy package for you to advocate for, which you can find in a simple, easy campaign for you to take action on. If you haven’t already, join us in asking Congress to prioritize rebuilding our economy with clean energy.

All set? Sent your letter in? If you skimmed the text that went to Congress, you got a preview into that wonk. From safe harbor to direct pay to lists of bill numbers– we get it, Michael. It’s tricky. So, we’re going to take a minute and explain it to you like you’re eight. (Yeah, we wish we could take it down to Kindergarten level, but let’s be honest, this shit is complicated.)

BACK TO BASICS

There are two things you should understand before we dive in.

- 1) First, in the face of the coronavirus pandemic, the clean energy economy is hurting. Study up with this blog post to understand the impacts, from job loss to project delays.

- 2) Second, Congress has the opportunity right now to choose how to rebuild our nation’s economy from this crisis. They can pass a stimulus package meant for economic stabilization, and we think the inclusion of clean energy is key.

Got it? Moving on.

GETTING WONKY

Right now, we’re asking Congress to consider including THREE things (you can count that on one hand!) in that stimulus package that we think are critical for the future for clean energy:

- 1) Postpone step downs and phase outs for tax credits

- 2) Delay commence construction, safe harbor, and place in service deadlines

- 3) Institute direct pay and/or refundable credits

Whoa. We’re back to making crazy faces at Oscar. What is he even talking about? Before we dive into those terms, we need to start with an overview of what the crap clean energy tax credits even are. Ready?

CLEAN ENERGY TAX CREDITS

Our government heavily subsidizes the development and extraction of fossil fuels. With energy sources like oil and coal receiving annual subsidies and tax breaks around the amount of $14 billion, it’s hard for clean energy to compete. We’ve been long advocates of clean energy tax credits, which keeps clean energy on a level playing field.

Since we’re eight, let’s put this into a Little League Scenario: Team Fossil Fuels gets the best snacks, has the coolest color t-shirts, has your best friend Jimmy’s dad as a coach, while Team Clean Energy gets no special treatment and is expected to compete at the same level. Cross your arms and yell it loud enough for the Chair of the Little League to hear: “IT’S NOT FAIR!”

We agree. We think that if Team Fossil Fuels gets all that spice, give a little to Team Clean Energy, too. Let ‘em compete fairly. After all, if we look at the “levelized cost” of clean energy– think: taking away all the doping and spa treatments away– clean energy is far more competitive in today’s market. In fact, Team Clean Energy is already winning: it’s cheaper than fossil fuels. But, if that Little League Boss isn’t going to take away the special treatment for Team Fossil Fuels, we have to give Team Clean Energy equal treatment. That’s where tax credits come in.

There are two major tax credits that POW strongly advocates for: the Investment Tax Credit (ITC) for solar energy and the Production Tax Credit (PTC) for wind energy. To keep it simple, today we’ll talk about the ITC.

THE INVESTMENT TAX CREDIT

The ITC was passed in the Energy Policy Act of 2005 to incentivize solar energy development. The credit applies to both residential and commercial systems, allowing homeowners or businesses (that install, develop, or finance the project) to deduct a certain percentage of the cost of installing the solar panels from their federal taxes. When passed, the ITC was a 30% credit, so let’s do some quick third grade math: if you install a $10,000 solar panel system on your house, with the ITC, you’d get a $3,000 credit on your federal tax return.

POSTPONING STEP DOWNS & PHASE OUTS

The hope has always been to retire the ITC as clean energy gains momentum. (But remember, if the government continues to outfit Team Fossil Fuels, clean energy is not competing on a level playing field.)

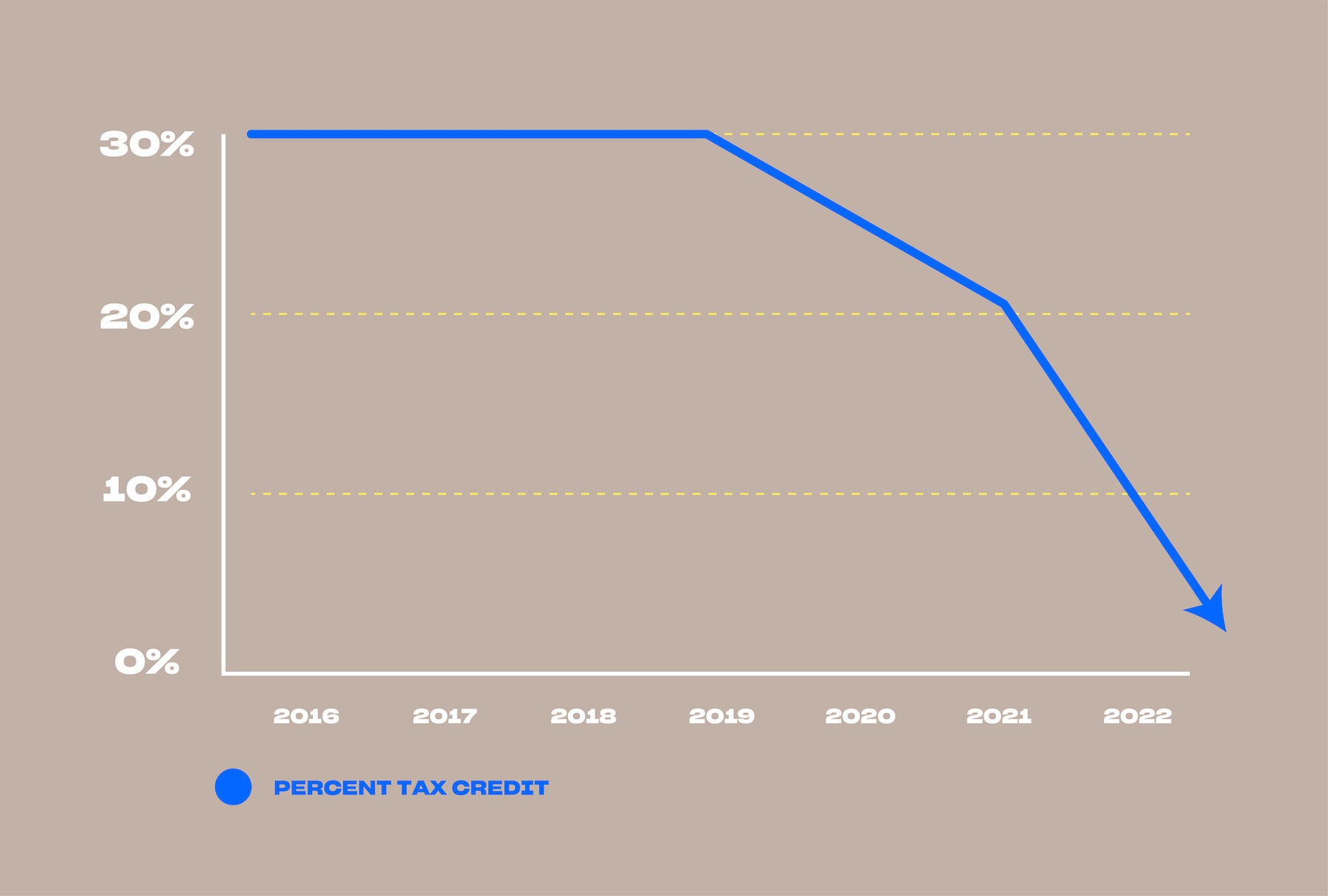

From 2016 to 2019, the ITC was a 30% credit. In 2020, the ITC steps down to 26%, and in 2021, it steps down to 22%, and in 2022, it steps all the way down to 10% (for commercial systems only). In 2022, the credit will be phased out for residential homes, and in 2023, the ITC will be completely phased out.

Unfortunately, due to the coronavirus pandemic, clean energy developers are hurting. Both developers and homeowners are facing the economic consequences of the crisis?, often unable to take advantage of that 26% tax credit. We’re asking Congress for a simple delay here. If we’re unable to utilize the tax credit this year– the tool that Congress itself created to grow clean energy– let’s delay the phase-out by a year. Instead of dropping to 26% this year and 22% next, let’s push that back a year.

Back to third-grade analogies. As you get older, it seems like you get fewer birthday presents, right? If your birthday party got canceled because of the coronavirus pandemic, can’t you just postpone it a year and collect the same amount of presents you would have received?

SAFE HARBOR, COMMENCE CONSTRUCTION, & PLACE IN SERVICE

Not surprisingly, when the government is handing out money, there are some rules that go along with it. To qualify for a tax credit, a clean energy developer needs to meet ‘safe harbor’ requirements. Stick with us! Safe harbor is a legal term for something that provides protection– if the developer checks off certain requirements, they can sail on into that safe harbor, kick back on the deck with a juice box (if we’re in third grade and all), and rest assured they will qualify for that tax credit.

Let’s try out an example. Your best friend Jimmy’s dad works for SunFun, the nation’s largest residential solar supplier. When SunFun installs solar panels on your school, they can qualify for the tax credit so long as they kick off construction (that’s called ‘commence construction’) or spend at least 5% of the total expenses in that first year, and they wrap up the project and get it up and running (that’s called ‘place in service’) within four years. Let’s say SunFun started developing a solar project in 2016, when the tax credit was 30%, and it will take four years to build. As long as they spent 5% of the total project expenses in 2016 or broke ground in 2016, and finished the project up within four years (by the end of 2020), they qualify for that 30% tax credit.

Now, let’s check in with reality. Let’s say SunFun sailed into that safe harbor by spending five percent on that project in 2016, but due to the current pandemic, they can’t get the project finished by the end of 2020, which is the required (remember that four year deadline?). Whether the issue is due to shipping delays, slowed permitting processes, or construction bans, SunFun loses that entire tax credit, and they don’t get that 30% on their investment back, entirely due to COVID-related delays.

Postponing step downs and phase outs of clean energy tax credits by delaying safe harbor, commence construction, and place in service deadlines allows the clean energy economy to utilize these tools moving forward and not forfeit the incentive solely because of the pandemic.

DIRECT PAY

One last thing. Another way to quickly infuse cash into the clean energy economy now to get them back to work is through direct pay policies, which literally pay developers directly. Stick with us for two quick examples:

First, back in the last recession, Congress passed the American Recovery and Reinvestment Tax Act of 2009, with the goal of increasing investments in clean energy. This bill created the ‘Section 1603’ program which reimbursed developers for a portion of the cost of installing clean energy. We’re advocating for the creation of a similar temporary direct pay grant program as part of the stimulus.

Second, we’re advocating for the ability to convert tax credits into direct cash payments by making credits refundable. Wait, what about the explain it ‘like I’m eight thing?’ Sure, but you don’t pay taxes when you’re eight, so you’re just going to have to trust us on this one: the ITC is not a refund, it’s a credit. Let’s say you’re stoked on putting solar panels on your roof, so you buy a $10,000 system. With a 26% credit this year, you’d receive a $2,600 tax credit. But let’s say you only owe Uncle Sam about $650 in taxes every year. Come April, you wouldn’t owe the IRS any money (because of that credit), and it would be the same for the next three years (until you use up the full $2,600 credit). You don’t just get a $2,600 cash rebate in year one. Making tax credits refundable would allow you to get that $2,600 up front: rather than carrying those credits forward, you get to take the credit in cash immediately.

Whether through a direct pay program or refundable credits, we’re able to get funding immediately into the pockets of homeowners and developers to keep our clean energy economy vibrant and growing.

YOU MADE IT